Cybersecurity in Fintech: Standards & Solutions for Safe System

Contents

As cyber criminals are getting sophisticated every day, fintech cyber security is evolving continuously, and new technologies are developed to beat them off. In that case, it is necessary to have adequate awareness and relevant experience in fintech cyber security.

What is Fintech Cybersecurity?

Fintech, a portmanteau of “financial technology”, was coined in the 1960s and has been popular in recent decades. It refers to companies utilizing the latest technology in competition with traditional financial methods when offering financial services. Four key areas of fintech are artificial intelligence, blockchain, cloud computing, and big data (“ABCD”).

With technology and innovation becoming more predominant in the finance sector, fintech has opened doors for opportunities for advanced customer experience. But in tandem with opportunities, there are inevitable challenges, among which cyber security in fintech is beyond doubt a grave concern.

Fintech cyber security means that fintech companies and their data are secured in the cyber environment. It involves how a firm can develop a safe fintech program and wage war on cyber crimes during that process.

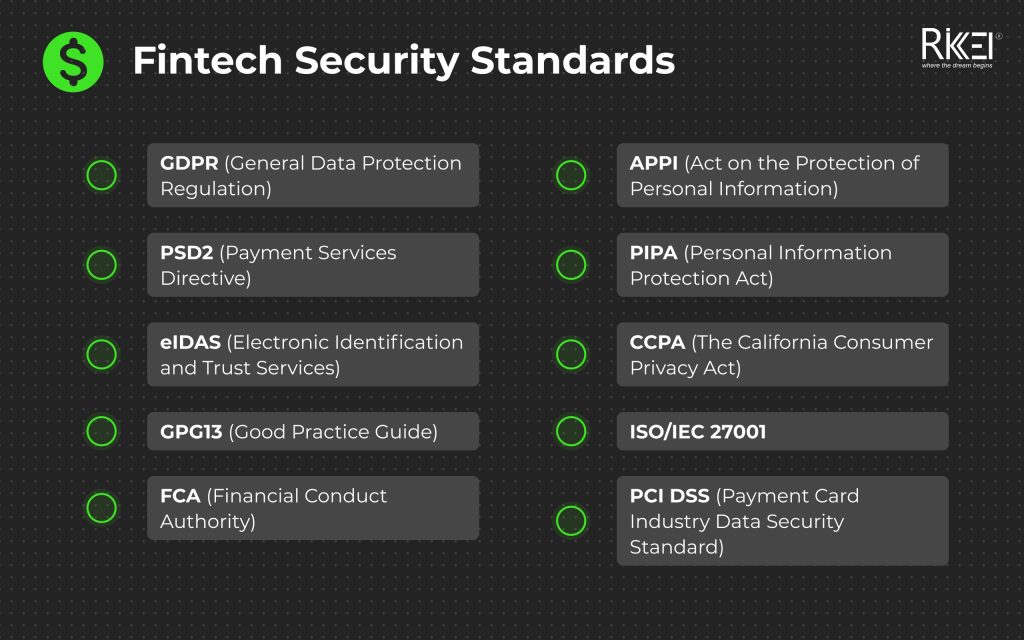

Fintech Cybersecurity Standards

Fintech firms must obey regulations relating to regional data protection and KYC (Know Your Customer) practices. Regional privacy legislation restricts fintech software on the data it can gather and process. Therefore, fintech providers must also be aware of how different countries interpret the same legislative concepts. Consequently, fintech apps must be developed with practical tools and an understanding of the local regulations. Fintech security standards depend on your location and target markets. The most common regulations include:

- GDPR (General Data Protection Regulation):. This is a set of rules for protecting privacy in fintech apps. It regulates the processing of private data for residents of the EU, even if the organization is outside the EU. GDPR isn’t applicable to European companies only – you must comply with this regulation if you want to work with EU residents and organizations.

- PSD2 (Payment Services Directive):. It stipulates the security of electronic payment services activities in the EU to help banking services secure their tech. PSD2 often overlaps with GDPR and lacks legislative clarity. Hence, you may need the help of cybersecurity consultants on this issue.

- eIDAS (Electronic Identification and Trust Services):. Like the two fintech security standards above, this is another EU regulation for cross-border electronic transactions. It focuses on providing a common legal framework for safe transactions between fintech companies, businesses, governmental bodies, and end-users.

- GPG13 (Good Practice Guide): regulates outsourcing companies and service providers that relate to the UK’s governmental system. This regulation is a part of the official Security Policy Framework that emphasizes cybersecurity, events logging, and intrusion detection systems.

- FCA (Financial Conduct Authority): This regulation functions as a supervisor of financial services in the UK. It aims to protect consumers and market integrity. Besides, fintech service providers in this country have to go through a registration procedure with the FCA.

- APPI (Act on the Protection of Personal Information):. This is applicable to financial technology companies that work with Japanese residents’ private data. Just like GDPR, APPI is cross-nation, meaning it applies to companies that are administered from other countries.

- PIPA (Personal Information Protection Act): regulates private data security measures for private and governmental organizations in South Korea. Unlike other FinTech compliance documents on our list, PIPA violators can face financial fines and criminal liability.

- ISO/IEC 27001:. This is a set of fintech security standards for information safety. It includes frameworks and policies that can help organizations all around the world establish and maintain secured data management systems. The full range of required standards depends on the size and location of your business.

- PCI DSS (Payment Card Industry Data Security Standard):. This is for companies that collect, process, and use credit card information. For example, if you’re a service provider working with MasterCard and Visa, you need to validate your services with this standard. There are four PCI DSS levels in total. The more transactions you work on every year, the more requirements you have to obey.

- CCPA (The California Consumer Privacy Act): This regulation is applicable to California, the US. It resembles GDPR despite a few differences, such as around definitions of legal terms.

Related post: 10 Fintech Service Examples in 2023

Fintech Cybersecurity Solutions

Companies that focus on brand value and financial well-being are also ones that opt for the latest techniques and strategies for cyber security in fintech. But how can they do this? Below are the most common fintech security solutions for fintech companies.

1. Data encryption

Encryption and tokenization are extremely effective fintech security solutions.

Encryption refers to a process of encoding critical information into codes that require special keys for deciphering it in a readable and understandable format. Tokenization means using a generated number (token) to replace sensitive data. People can decrypt the original information into a readable format with unique databases (aka token vaults).

Complex technologies and encryption algorithms that companies can use to secure their important data include:

- RSA: It’s a firmly secure asymmetric algorithm with public encryption and private encryption keys.

- Twofish: It’s a freeware algorithm encrypting data into 128-bit blocks.

- 3DES: This is a popular encryption method for encrypting credit card PINs.

- P2PE: It stands for Point-to-point encryption.

- EMV. It stands for Europay, Visa, and MasterCard.

2. Access control based on roles

A FinTech app typically can include the roles of an admin, manager ,IT specialist, support staff, and the customer. Role-based access control (RBAC) can then be used to limit access to a network depending upon the user’s relationship with the fintech company.

This makes sure that access is restricted. Thanks to this, ordinary employees and end-users can’t access corporate information. Consequently, the company can reduce internal and external security threats. However, keep in mind that RBAC-enabled product development requires firm engineering capabilities and high technical expertise.

3. Secure application logic

It is imperative that cyber security in fintech is associated with a strict password policy. But that’s just not enough to protect your fintech apps from cyber attacks. You should also implement precise authentication methods, including:

- Adaptive authentication: Multi-factor authentication is not that versatile. In fact, it can even amplify data breach risks (for instance, if a hacker manages to clone your smartphone). But adaptive authentication is different, it is among the most effective fintech security solutions. It allows your system to analyze users’ behavior to detect suspicious activities. Therefore, your platform will gain extra protection of financial data and private information.

- One-Time Passwords (OTPs): OTPs, also known as Dynamic PINs, work as additional layers of safety. How is that? The software automatically generates an extra limited-time password each time a user wants to log into the account or complete a checkout process.

- Compulsory password change: According to a report, more than 80% of data leakages and breach incidents in 2019 were resulted from a compromised password.. Fintech companies can dramatically reduce security risks by forcing customers and employees to change their passwords regularly. To illustrate, many online banking applications enforce resetting of users’ account passwords every three or six months.

- Monitoring: Using a tracking system, you can analyze and keep tabs on suspicious activity (such as failed log-in attempts) to detect possible unauthorized access. Plus, this solution can prevent data insecurity by blocking an account after several suspicious transactions.

- Time-limited log-in sessions: Restricted session time is one of the most ideal fintech security solutions. This is because even if a hacker successfully accesses the account, they’ll have to take important data in limited time.

4. Testing

Regular testing is another solution for protecting fintech data security. To do this effectively, companies can:

- Set up a professional security testing team: You need verified engineers and managers who will come up with realistic data breach scenarios and upgrade your code. You should consider hiring fintech security testers from an outsourcing provider because it’s fast and cost-effective.

- Carry out penetration tests: Penetration testing means faux attacks on your app. This can help you identify potential vulnerabilities and patch them up with attack-resistant code.

- Run an IT security audit: This is more than just testing. It’s a sophisticated process that can uncover technological errors, assess fintech compliance, and verify your security strategy’s effectiveness.

Related post: Top 20 Fintech Software Development Companies

Fintech Cybersecurity Risks

As a matter of fact, building a solution with fintech data security can’t just be done overnight. There are fintech security concerns and risks that we might be aware of to avoid. Below are some of the most common.

1. Identity management

Frictionless data sharing is a key attribute of fintech. But there’s a but.

Financial companies gather tons of data, thereby establishing data ownership and digital identity management concerns. What happens to the client’s info after they unsubscribe? Your company must implement data deletion mechanisms and you’ll face compliance issues if you don’t. What if someone steals the data you didn’t delete? Have a look at the next challenge of fintech – data security.

2. Data security

According to the Ponemon Institute 2019 Study, around $18.5 million is spent by capital market companies and banks every year to combat cybercrime. And if that’s not enough, the annual cost of cyber attacks is up to $18.3 million per financial service provider.

These service providers gather a deluge of personally identifiable information, including financial, contact, and health data about visitors, customers, and staff. Hackers target weaknesses in the system to exploit those types of information. To make it worse, most companies don’t know about the attacks until it’s too late. According to Bitdefender’s survey, approximately 64% of fintech companies aren’t aware of data breaches in their systems.

3. Regional Security Requirements

As mentioned in the Fintech Cybersecurity Standards section, fintech companies must follow regulations concerning regional data protection and KYC (Know Your Customer) practices. And privacy legislation at a regional level restricts fintech software on the data that can be gathered and processed.

Therefore, fintech apps must be built with practical tools and an understanding of the regional regulations. In the absence of this, a fintech organization may isolate itself from some markets.

How to Improve Cybersecurity in Fintech

When you’ve learned some of the most popular fintech security issues, it’s vital that you adopt methods of improving cybersecurity in fintech. Here are some highly suggested for you.

1. Implementing strict security policies

Strict policies build a firm foundation for your risk management so it’s a must that you have your own well-planned set of policies. When developing your security policies, you should consider:

- Setting clear goals, objectives, and expectations

- Selecting and implementing security frameworks

- Mapping out security processes, procedures, and tools

- Planning best incident response & disaster backup plans

- Setting up roles and responsibilities

- Continuously monitoring security risks

- Emphasis on developing cyber resilience

- Regular policy updates

2. Utilize AI, ML, and Analytics

Advanced technologies are giving companies a leg up in fintech cybersecurity. AI, ML, and analytics assist proactive threat detection. Furthermore, they ensure faster analysis of large volumes of data.

With them, you can detect, predict and prevent the following threats in real-time:

- Known security risks

- Financial hacks

- Emerging threats

- Unauthorized access and usage of data

3. Continuous monitoring threats

Hackers never spoil a chance to steal your critical data. You are better off not relying on traditional signature-based detection techniques. Instead, turn to the following:

- Worldwide threat intelligence

- Contextual awareness

- Custom regulations

Centralized visibility is of great importance for threat monitoring. Real-time alarms and triggers help you to upgrade fintech cybersecurity.

4. Proactive vulnerability management

Vulnerabilities easily pave the way for cyber criminals. Therefore, never forget to identify, assess, and prioritize vulnerabilities. You can do this by simultaneously minimizing the attack surface and protecting your susceptible endpoints.

5. Effective third-party risks management

BFSI sectors must use third-party apps, services, and APIs. In the context of increasing supply chain attacks, you can’t ignore risks from third parties. Additionally, always choose partners after thorough verifying. Make sure you check their expertise in the BFSI industry.

6. Pay close attention to API security

API risks and AppSec risks are not the same. With the growing use of APIs in the BFSI sector, you must manage API risks. Add managed API protection to boost your API security. It plays a vital role in cybersecurity in the banking and finance sectors.

7. Maintain ransomware resistant backups

Ransomware attacks are targeting financial organizations. The best method to avoid paying the ransom is to have a backup. If you are under attack and lose all your data to the hackers, you can recover with backups.

To do this, you should:

- Store secure backups in an offline location

- Raise backup frequency

- Turn to immutable storage

- Integrate anti-malware protection into backup servers

8. Create a cybersecurity culture

Phishing is a common method to breach banking security. This term refers to a type of fraud involving sending emails purporting to be from reputable companies, with a view to inducing individuals to reveal personal information, such as credit card numbers or passwords. Preventing the exploitation of human errors and creating a strong cybersecurity culture within your organization is necessary. To accomplish this:

- Continuous employee awareness is imperative

- They must understand what to click and what not to

- If something suspicious occurs, they should know what to report and to whom

Conclusion

Above are what you need to understand about fintech and security, including popular regulations, risks, solutions, and advice on how to improve cybersecurity in fintech. They are fundamental in developing a secure fintech software, as well as protecting it from cyber criminals.

More From Blog

August 8, 2024

Data-Driven Product Development: Strategy To Drive More Sales

As a business owner, you want your products or services to be well-received upon launch. The most effective way to create a product that satisfies a broad range of customers is to gain insights into their needs and behaviors from the outset. The key lies in data-driven product development, a strategy that many companies have […]

August 8, 2024

7 Steps To Establish A Data-Driven Governance Program

While data-driven approaches significantly benefit organizations in various ways, failure to govern the huge data sets will hurt your business even more. Effective data management also ensures data quality and security. That’s why there is an increasingly high demand for data-driven governance programs. Continue reading for a detailed guide! What Is Data-Driven Governance? Surprisingly, many […]

August 8, 2024

Data-Driven Business Transformation: 7 Steps To Follow

Data empowers businesses to make well-informed decisions in different departments, like marketing, human resources, finance, and more. As a business owner, you should also employ data-driven approaches to skyrocket productivity and efficiency. If you are still new to this concept, scroll down for an in-depth guide on data-driven business transformation. What Does A Data-Driven Business […]

August 8, 2024

Data-Driven Security: Transforming Protection Through Analytics

Cybersecurity was once an afterthought for most organizations. But in today’s digital landscape, it has become mission-critical. With this transformation has also come a shift in how security decisions are made. Rather than relying solely on intuition and tradition, leading organizations are embracing data-driven strategies. By using metrics and insights around threats, vulnerabilities, and more, […]

August 8, 2024

Differences Between Data Science and Computer Science

Data Science and Computer Science are distinct fields overlapping in certain areas but have different focuses and objectives. The article below will help you clearly understand the differences and the close connection between the two fields. What is Data Science? Data Science is an interdisciplinary field that combines scientific methods, processes, algorithms, and systems to […]

August 8, 2024

How Real-Time Data Analysis Empowers Your Business

In today’s fast-paced business landscape, the ability to quickly make data-driven decisions has become a key differentiator for success. Real-time data analysis, the process of analyzing data as soon as it’s generated, has emerged as a powerful tool to empower business across industries. By leveraging real-time data analysis, organizations can gain timely and actionable insights, […]