Top 25 Best Personal Finance Apps: Banking, Investing, & Managing Tools

Contents

Finance management is vital for any individual or business. Fortunately, personal finance apps are an effective solution for spending plans and budget management. Because they deliver a smarter process helping users save valuable time in keeping track of expenses.

A survey by The Penny Hoarder found that 40% of people using spreadsheets for budget management, and 50-60% of people using finance apps. The survey also reveals that people are 25 to 44 years old are more likely to use an app to budget.

So, mobile app development or software development for finance is going to be a cash cow.

Let’s discover the features and a list of the best personal finance apps by taking a look at this article.

Features Personal Finance App Must Have in 2023

1. Data visualization

Data visualization is one of the must-have features of a finance app. Intuitive charts and dashboards are attractive and user-friendly. Besides, displaying data in charts and dashboards makes the information understandable and manageable for users.

Thus, if you want to make your app become a cash cow, create one with data storytelling features and stunning dashboards. It will take over the finance mobile app market.

2. Data Security

In fact, any kind of app requires high security. However, financial data is the most sensitive data to be secured. Personal finance app has to comply with modern data processing and management standards, such as GDPR and ISO 270001. Thus, quality assurance and testing, security audits, cloud infrastructure, and managed IT services are the important stages for a finance mobile app development project.

Along with data visualization, data security is also one of the most important factors that users consider when choosing the best app for personal finance.

3. Personalized Experiences

Personalization for personal finance apps might include UI/UX optimization or automated features, such as logical interface, quick search, or related recommendations. By tailoring the experience to the user’s needs, personal finance apps become more appealing to the customer. Custom mobile app development is often the right solution for businesses who want to create a highly-personalized mobile app.

4. Integration

Probably, integration is convenient for end-users. A finance app must integrate with other payment systems or even shopping apps. This feature does not only exist on finance apps. Today, most mobile apps have the integration ability to be user-friendly and improve the shopping experience for users.

5. AI-Driven

AI-Driven features have the potential to enhance user experiences. AI designs are known to improve the creative process and bring customer relationships to a new level with an excellent user experience. Besides, using AI in data analytics can collect and analyze huge blocks of data and suggest practical ways to enhance user experience to draw sales. The real ability of AI is not only in collecting data but also the way we use AI in data.

You might be interested in:

Cybersecurity in Fintech: Standards & Solutions for Safe System

10 Best Programming Languages for Finance & FinTech

Best Personal Finance Apps in 2023: Banking, Investing, & Planning Tools

Let’s discover the list of the best personal finance apps based on many objectives: banking, investing, and planning.

Digital Mobile Banking Apps

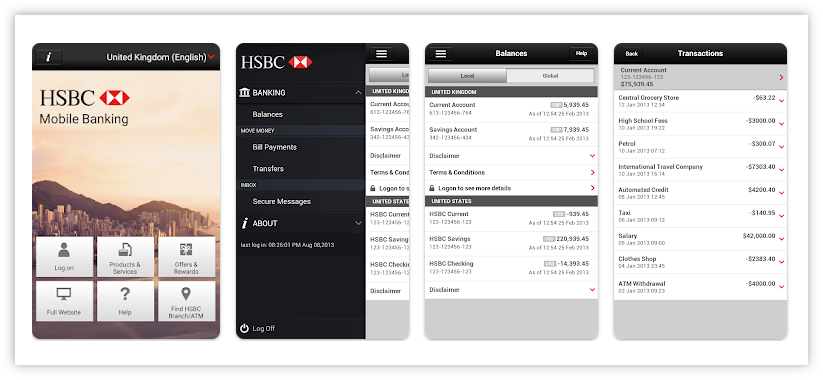

1. HSBC

HSBC Holdings is a British multinational universal bank and financial services holding company. Concurrently, beating BNP Paribas, it is the largest bank in Europe by total assets of US$2.953 trillion (as of December 2021).

You can stay in control of your finances easily with this HSBC Mobile Banking app. The app lets you manage your banking wherever you are with many benefits: keep a close eye on your transactions, move money with ease, log on with touch ID or face ID, digital secure key and so on.

HSBC Mobile Banking app also reveals the information about data safety:

- No data shared with third parties

- Data is encrypted in transit

- Data can’t be deleted

- Data collected: location, personal information, financial info, messages, files and docs, app activity, app info and performance.

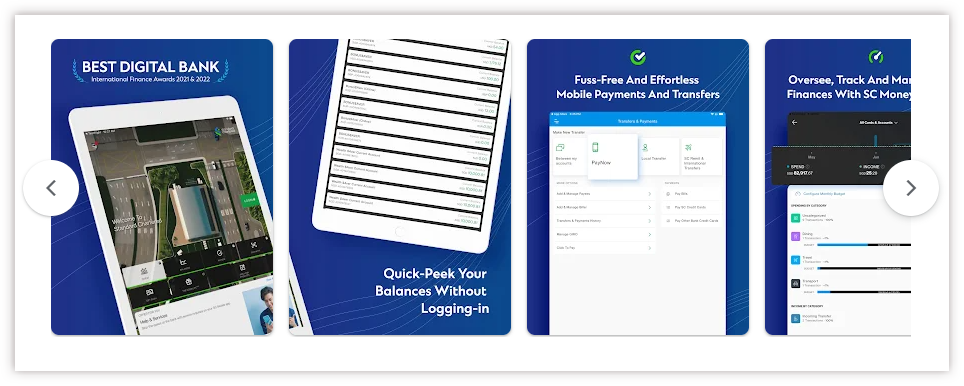

2. Standard Chartered

Standard Chartered (SC) is a multinational bank headquartered in London, England, offering banking services for some of the world’s dynamic market like Asia, Africa, and the Middle East. The company’s segments include corporate, commercial & Institutional banking, and consumer.

SC mobile banking app gives users the ability to transfer funds, pay bills and check account balances. This application has an easy-to-use interface and simple actions.

Standard Chartered also provides the information about data safety:

- Data may be shared with third parties: app activity, app info and performance

- No data is collected against privacy consent

- Data is encrypted in transit

- Ability to request that data be deleted

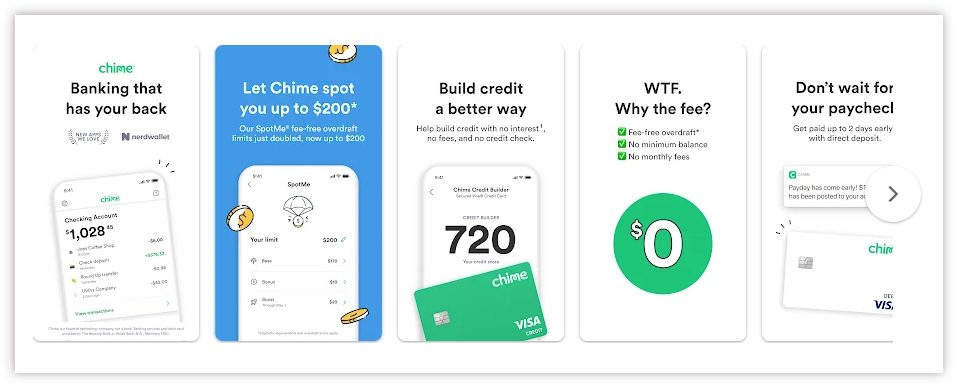

3. Chime

Although Chime Financial, Inc is an American financial technology company, not a bank, it provides financial services, including banking, payment, planning. Chime has no physical branches and does not charge monthly or overdraft fees, nor does it require an opening deposit or minimum balance to open a free checking account.

Chime Mobile Banking App also provides the information about data safety:

- Data may be shared with third parties: personal info, financial information, app activity, device or other IDs

- Data collected: location, personal information, financial information, photos and videos, files and docs, app activity, app info and performance, device or other IDs.

- Data is encrypted in transit

- Ability to request that data be deleted

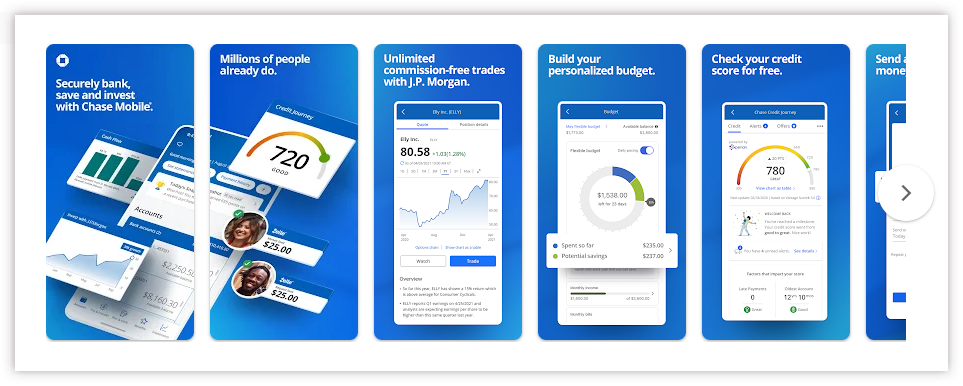

4. Chase

Chase or Chase Bank is an American national bank headquartered in New York City, offering online banking, credit cards, mortgages, commercial banking, auto loans, investing & retirement planning, checking and business banking services.

Chase Mobile provides the information about data safety:

- Data may be shared with third parties: personal info, financial information, and app activity

- Data collected: location, personal information, financial information, photos and videos, files and docs, app activity, app info and performance, device or other IDs.

- Data is encrypted in transit

- Data can’t be deleted

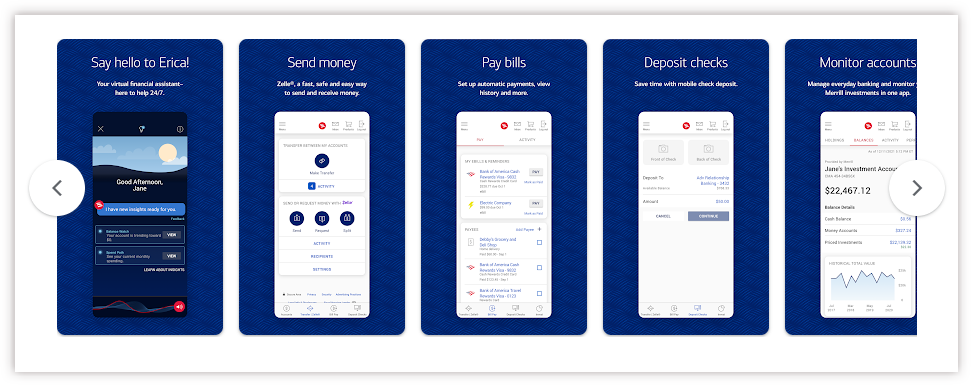

5. Bank of America

As its name, Bank of America Corporation is an American multinational investment banking and financial services. The bank was founded in San Francisco and headquartered in Charlotte, North Carolina. It is one of the world’s largest financial institutions, serving individuals, small- and middle-market businesses and large corporations.

Bank of America Mobile Banking provides the information about data safety:

- No data shared with third parties

- Data collected: audio

- Data is encrypted in transit

- Data can’t be deleted

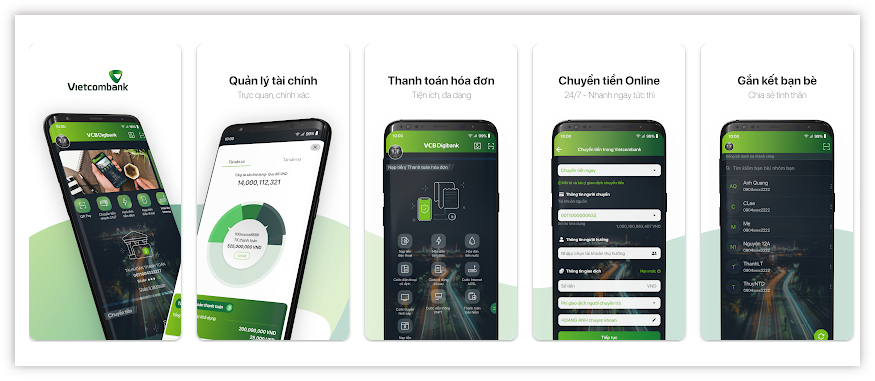

6. Vietcombank

Joint Stock Commercial Bank for Foreign Trade of Vietnam, commonly referred to as Vietcombank, founded in 1963, is the most prestigious commercial bank in Vietnam with over 600 branches and office locations. The bank offers a wide range of financial services, including online banking, credit cards, and remittance payment support. The bank’s charter capital is one billion USD.

Vietcombank Mobile Banking App provides the information about data safety:

- No data shared with third parties

- Data collected: location, personal information, financial information, photos and videos, files and docs, app activity, app info and performance, device or other IDs.

- Data is encrypted in transit

- Data can’t be deleted

7. BIDV

The Joint Stock Commercial Bank for Investment and Development of Vietnam, commonly known as BIDV, is a Vietnamese state-owned bank in Vietnam. The bank’s charter capital is 361 million USD. With the aim of improving customer experience, Vietnam Joint Stock Commercial Bank for Investment and Development (BIDV). BIDV SmartBanking has an intuitive interface providing financial transactions and digital utilities.

BIDV SmartBanking delivers the information about data safety:

- No data shared with third parties

- Data collected: location, personal information, photos and videos, app activity, app info and performance, device or other IDs.

- Data is encrypted in transit

- Data can’t be deleted

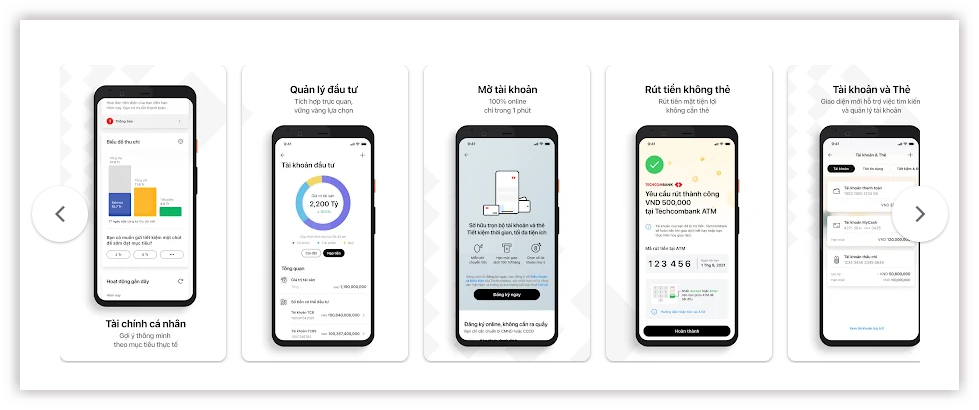

8. Techcombank

Techcombank is Vietnam Technological and Commercial Joint Stock Bank, founded in 1993. Outstanding benefits of Techcombank Mobile are transferring money with no hassle, flexible change, and convenient financial management.

Techcombank Mobile delivers the information about data safety:

- No data shared with third parties

- No data collected

- Data is encrypted in transit

- Data can’t be deleted

Financial Investing Apps

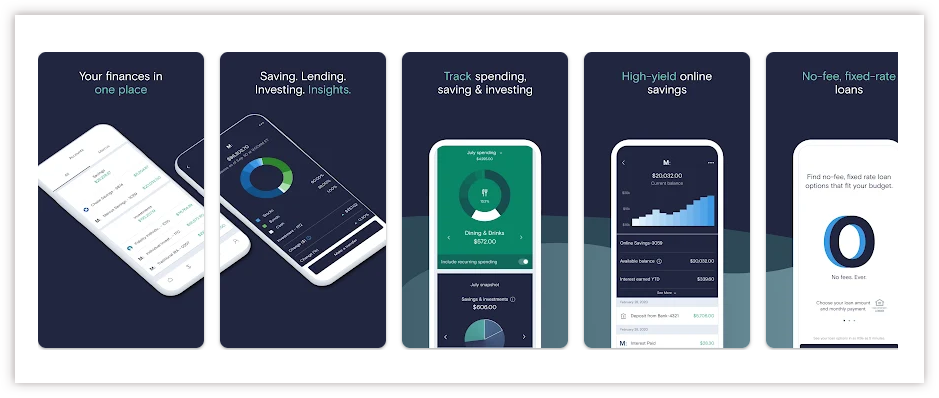

9. Marcus by Goldman Sachs

Marcus by Goldman Sachs is a brand of Goldman Sachs Bank USA, offering personal financial services to help customers save, borrow, and invest with competitive APYs. Marcus is known as one of the best personal loans provider in the market. Moreover, Mascus boast having, “No fees ever” because they don’t charge origination fees, fees for paying the loan off earlier than required, or even fees for paying late. Thus, Marcus’ services are called high-yield services.

Marcus by Goldman Sach App delivers the information about data safety:

- Data may be shared with third parties: personal info, and device or other IDs

- Data collected: location, personal information, financial information, message, photos and videos, files and docs, app activity, app info and performance, device or other IDs.

- Data is encrypted in transit

- Data can’t be deleted

10. Axos

Axos Invest Managed Portfolios is a product by Axos brand, offering automated investing, commission-fee trading, and more. This app by Axos has both pros and cons.

Pros: competitive management fee, multiple goals for investing, offering tax-loss harvesting, high degree of portfolio customization, good customer service.

Cons: limited number of account, poorly designed app, lacks a viable educational portal.

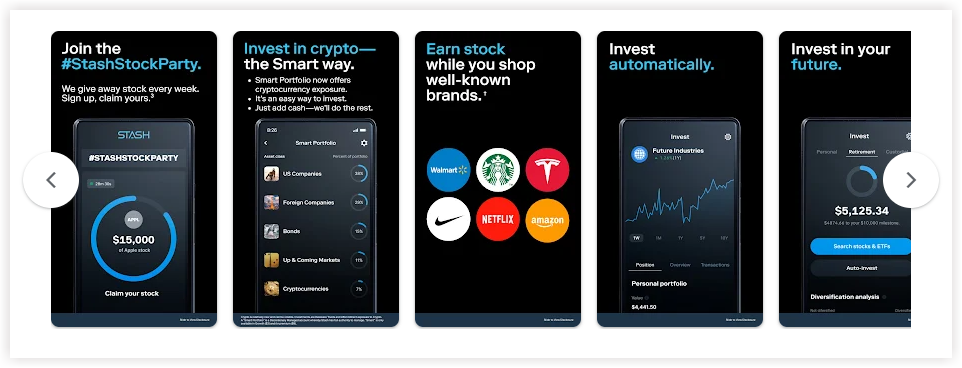

11. Stash

Stash, an financial investing app for beginners, based in New York, making investing in stocks, ETFs and crypto a breeze. Stash charged $3 – $9 per month, and $0 account minimum. There is no promotion available while using app.

Stash, mobile app for finance, delivers the information about data safety:

- No data shared with third parties

- Data collected: location, personal information, financial information, message, app activity, app info and performance, device or other IDs.

- Data is encrypted in transit

- Ability to request that data be deleted

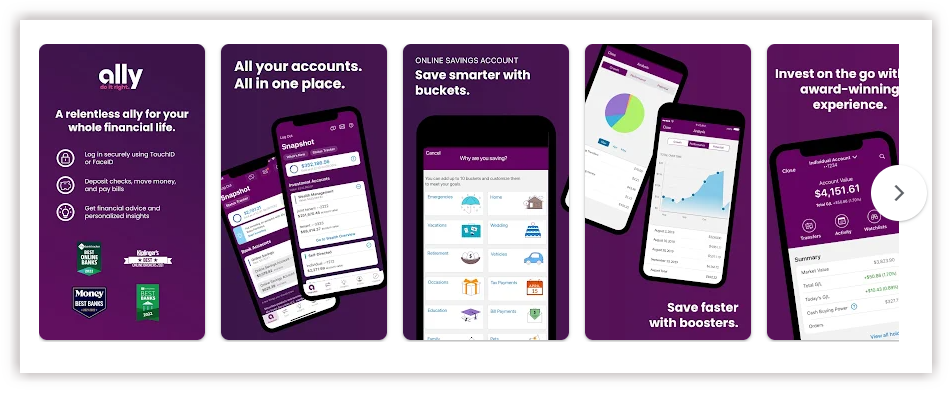

12. Ally Invest

Ally Invest was founded in 2005, headquartered in Charlotte, North Carolina, United States. It offers banking, investing, home loans services with competitive price. Ally Invest app charges $0 account minimum and $0 trading commissions and a low $0.50 options-contract fee. They also provide a strong web-based platform.

Ally Invest app delivers the information about data safety:

- Data might be shared with third parties: Contacts

- Data collected: location, personal information, financial information, files and docs, app activity, app info and performance, device or other IDs.

- Data is encrypted in transit

- Data can’t be deleted

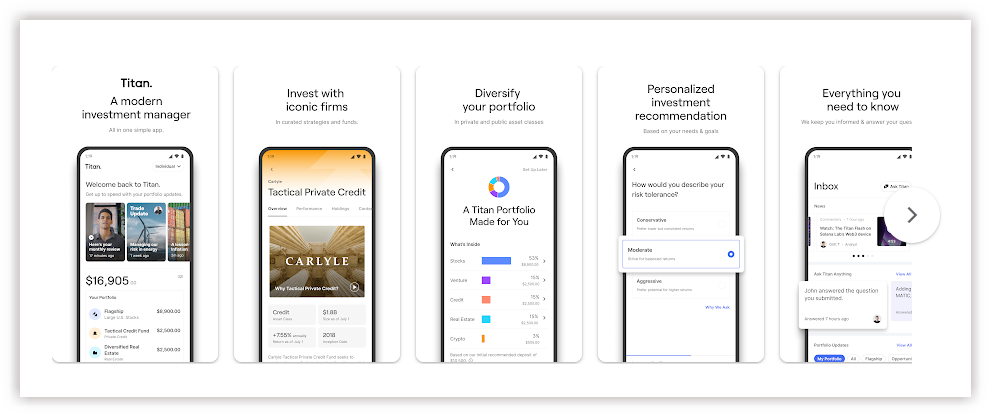

13. Titan Global Capital Management

Titan Global Capital Management is an investment consultant company in New York that operates an asset management platform. They offer active portfolio management for a wide range of clients, including stocks, real estate, venture capital, credit, and cash. Titan charges 1% for balances of $10,000 or more ($5/month for lower balances), $100 for account minimum, and a $50 sign-up bonus when you open and fund (minimum $100) an account with Titan.

Titan – Modern Investing app delivers the information about data safety:

- Data might be shared with third parties: app activity, app info and performance

- Data collected: location, personal information, financial information, files and docs, device or other IDs.

- Data is encrypted in transit

- Data can’t be deleted

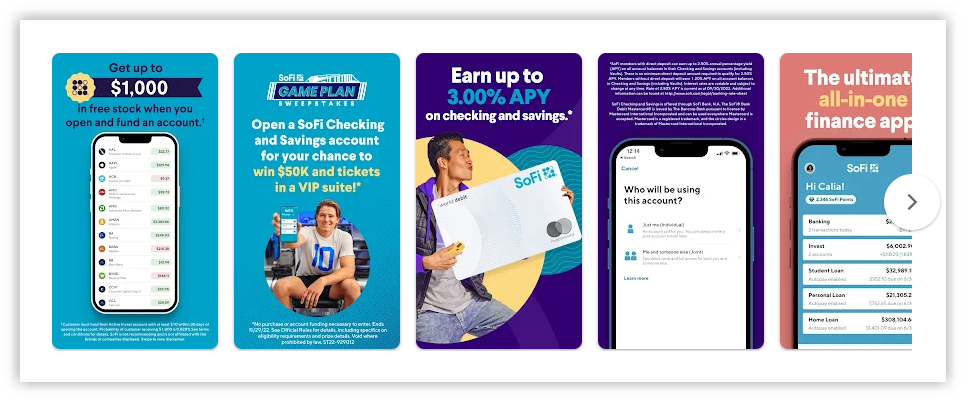

14. SoFi

SoFi Technologies, Inc is an American multinational finance company and online bank. Headquartered in San Francisco, SoFi provide an all-in-one financial app, offering personal loans, banking, credit services, private student loans, mortgage loans, investments, and insurance.

SoFi all-in-one app delivers the information about data safety:

- Data might be shared with third parties: personal info, financial information, photos and videos, files and docs, app activity, app info and performance, device or other IDs.

- Data collected: personal information, financial information, files and docs, app activity, app info, and performance, device or other IDs.

- Data is encrypted in transit

- Data can’t be deleted

Money Management Apps

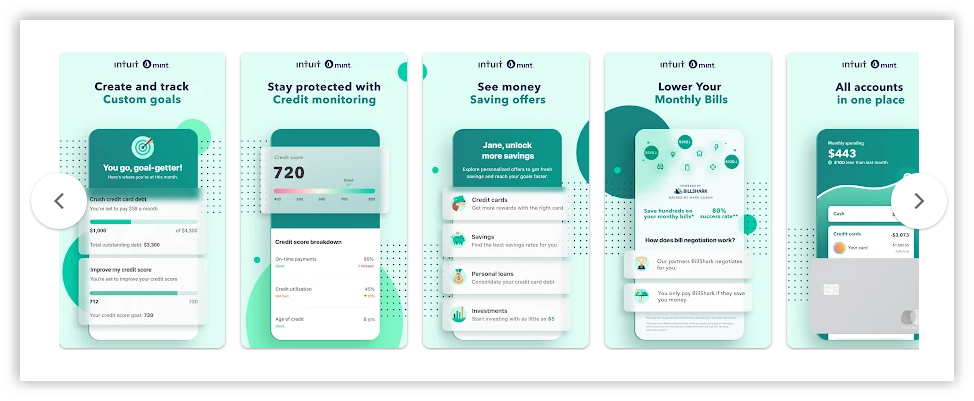

15. Mint

Mint, also known as Intuit Mint, is a intelligent personal financial management website and mobile app for the US and Canada. It was founded in 2009 and is headquartered in Mountain View, CA. The key product by Mint is a money management app that brings all financial services.

As a money manager, Mint: Budget & Tracking Bills app helps users see all accounts, credit cards, investments, and bills on only a screen. It also tracks the cashflow and gains insights that make opportunities to save.

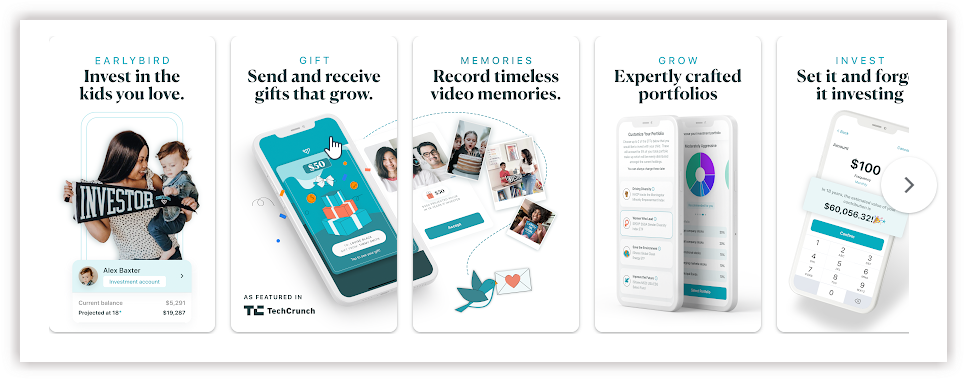

16. EarlyBird

EarlyBird is a venture capital investor focused on the European market. Their slogans, which are “Invest In The Children You Love”, “Invest early, grow together”, and “Invest. Gift. Grow”, reveal the services and benefits they can offer. They summarize those benefits in 3 lines:

- Build a modern portfolio in minutes

- Grow wealth with gifts from loved ones

- Celebrate and save special moments

EarlyBird app delivers the information about data safety:

- Data might be shared with third parties: personal info

- Data collected: personal info, app info, and performance, device or other IDs.

- Data is encrypted in transit

- Ability to request that data be deleted

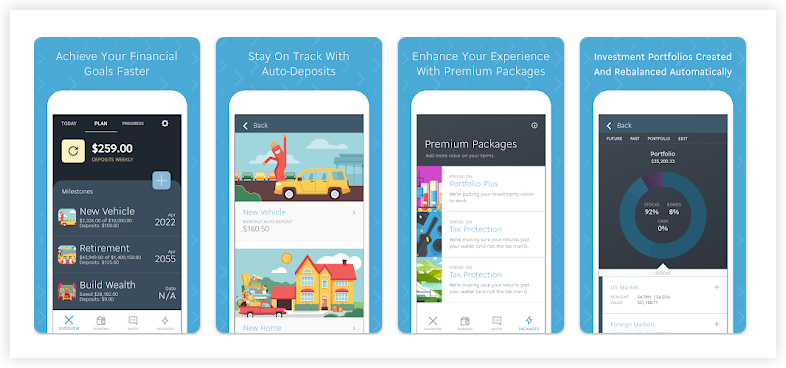

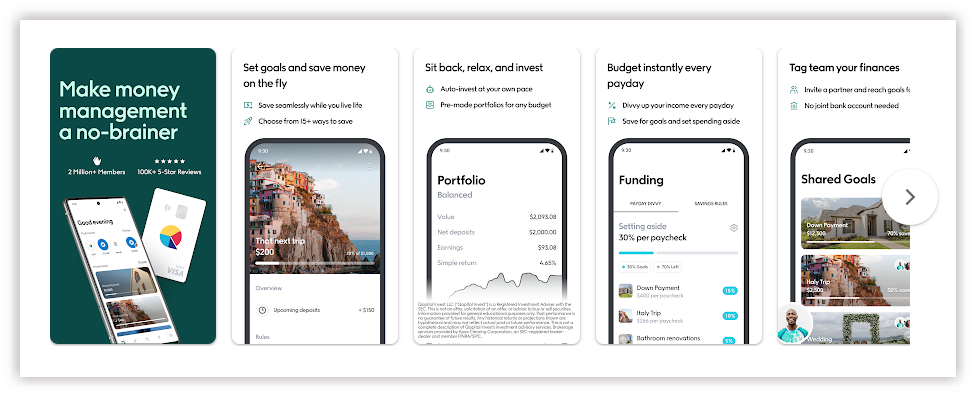

17. Qapital

Qapital is a personal finance mobile application for the iOS and Android operating systems, developed by Qapital, LLC. Its purpose is to bring happiness by saving, spending, and investing with goals in mind.

Qapital money management app delivers the information about data safety:

- Data might be shared with third parties: personal info

- Data collected: location, personal info, financial info, app activity, app info and performance, device or other IDs.

- Data is encrypted in transit

- Data can’t be deleted

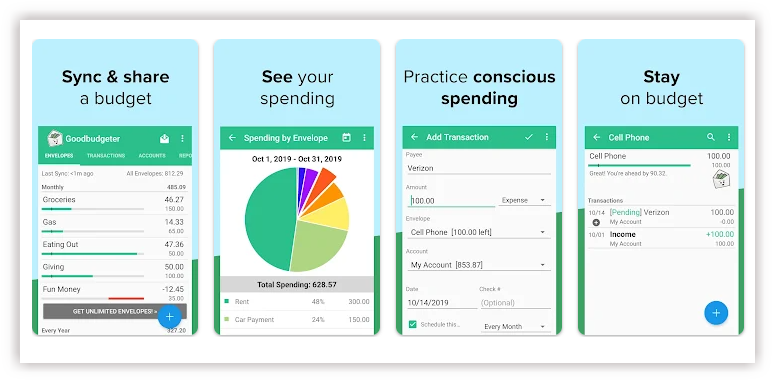

18. Goodbudget

Goodbudget (formerly EEBA, the Easy Envelope Budget Aid) is a personal finance app for budget planning, debt tracking, and money management. Users can access the app via your web browser or download the free app on iOS and Android devices from the App Store and Google Play store. With an email address and password to sign up, allocating budget now is easy.

Goodbudget: Budget & Finance app delivers the information about data safety:

- No data shared with third parties

- Data collected: location, personal info, financial info, app activity, app info and performance, device or other IDs.

- Data is encrypted in transit

- Ability to request that data be deleted

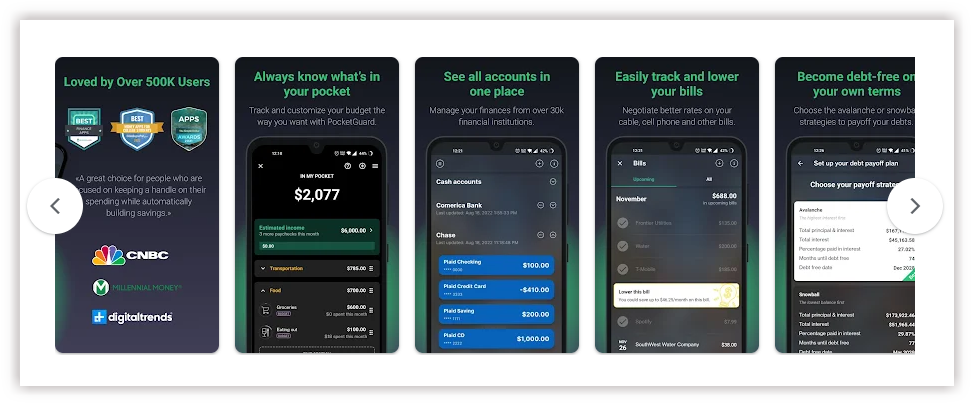

19. Pocketguard

Pocketguard is another intelligent finance mobile app that can help you track your cashflow, and money management. Because this app syncs with your bank and credit cards, you can view all of your cash flow in one screen, and it automatically updates your actual income and latest transactions.

PG: Budget, Bills, Goals, Debt app by Pocketguard, delivers information about data safety:

- No data shared with third parties

- Data collected: location, personal info, financial info, photos and videos, files and docs. app activity, app info and performance, device or other IDs.

- Data is encrypted in transit

- Ability to request that data be deleted

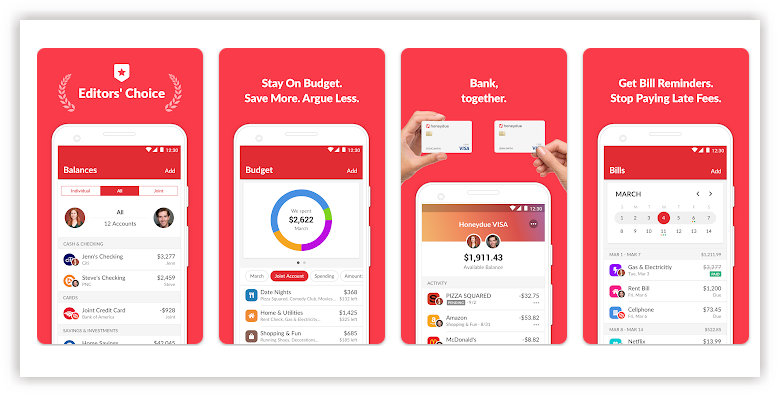

20. Honeydue

Honeydue is a free finance mobile app for couples. It can track all of bank accounts and your bills. Penalties will never happen because the app reminds you when it’s time to pay. Besides, when couples are ready, they can upgrade to a Honeydue joint bank account, together.

Honeydue: Couples Finance app delivers information about data safety:

- Data might be shared with third parties: personal info, app info and performance, device or other IDs.

- Data collected: location, personal info, financial info, messages, photos and videos.

- Data is encrypted in transit

- Ability to request that data be deleted

Insurance Apps

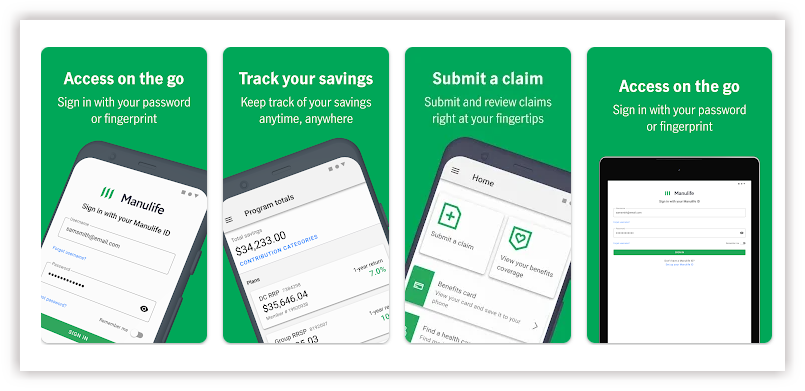

21. Manulife

Manulife is no stranger to us. Manulife is an international financial corporation that provides financial services, such as insurance, investment. With global headquarters in Toronto, Canada they serve members worldwide easily. At the end of 2021, they had more than 38,000 employees, over 119,000 agents, and thousands of distribution partners, serving over 33 million customers.

Manulife Mobile app delivers information about data safety:

- Data might be shared with third parties: app activity, app info and performance, device or other IDs.

- Data collected: location, personal info, financial info, files and docs, app activity, app info and performance.

- Data is encrypted in transit

- Ability to request that data be deleted

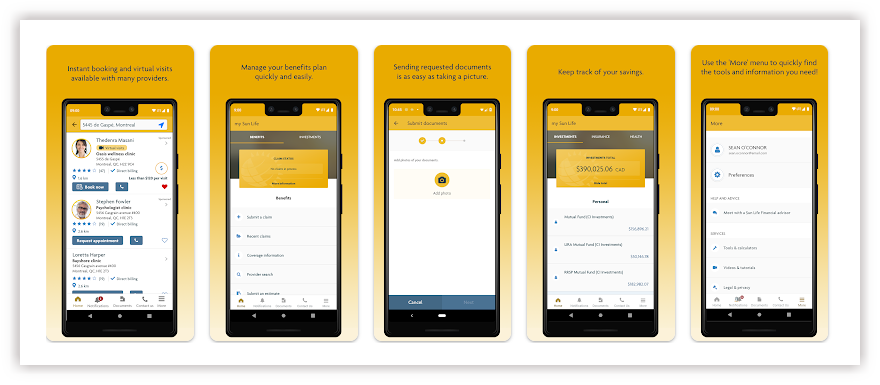

22. Sun Life

Sun Life Financial Inc. is a Canadian financial services company that has a presence in investment management with over CAD$1.3 trillion. The Sun Life mobile app is reviewed fast, easy to use, and secure access to:

- Group benefits,

- Personal life and health insurance,

- Group registered retirement savings plans (RRSPs),

- Individual or group savings plans,

- Insurance claims, and e-claims,…

Sun Life Mobile app delivers information about data safety:

- Data might be shared with third parties: device or other IDs.

- Data collected: personal info, financial info, health and fitness, photo and videos, files and docs, app activity.

- Data is encrypted in transit

- Data cannot be deleted

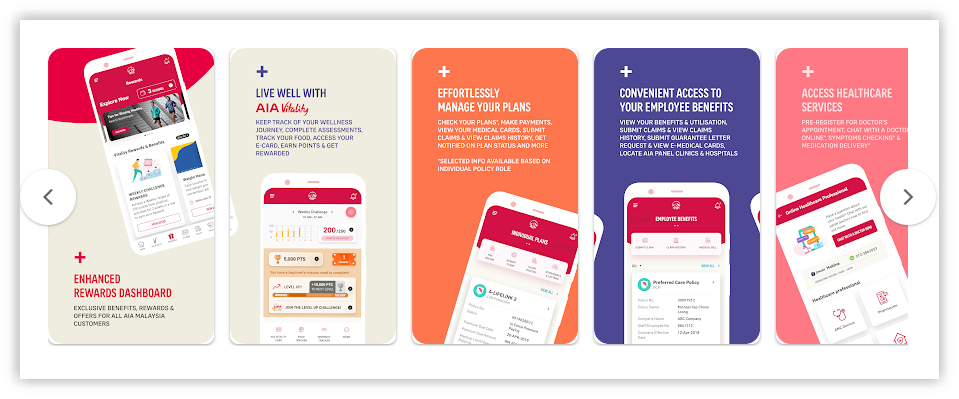

23. AIA

AIA Group Limited, known ass AIA, is a Hong Kong-based American multinational insurance and finance corporation. They have 18 markets, and more than 17 million group insurance scheme members worldwide.

My AIA: Insurance & Wellness delivers information about data safety:

- No data shared with third parties

- No data collected

- Data is not encrypted

- Data cannot be deleted

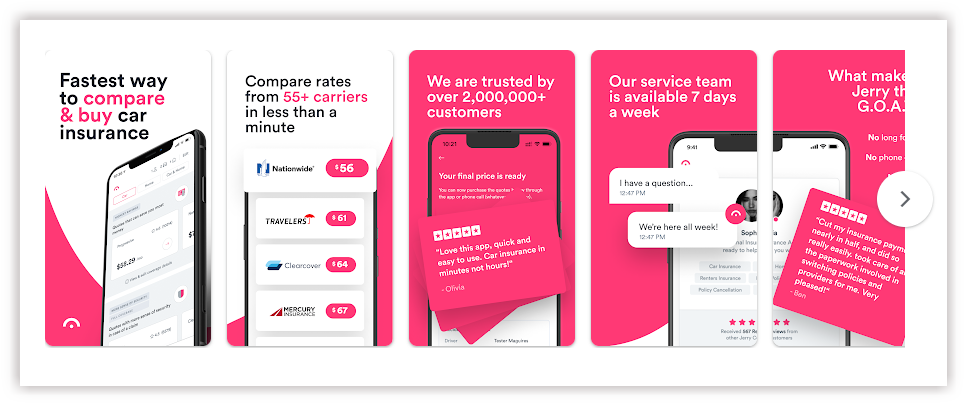

24. Jerry

Jerry app is not a car insurance app, is an intelligent third-party app helping users compare quotes from more than 50 top insurance companies in a minute. Simply compare car insurance quotes and choose the best one suits your needs. Some outstanding benefit from Jerry app are: sign up in 45 seconds, get quotes from up to 50+ insurance companies, switch and save by simply clicking a button.

Jerry: Car Insurance Savings app delivers information about data safety:

- No data shared with third parties

- Data collected: location, personal info, financial info, photo and videos, files and docs, app activity, app info and performance, device or other IDs.

- Data is encrypted in transit

- Ability to request that data be deleted

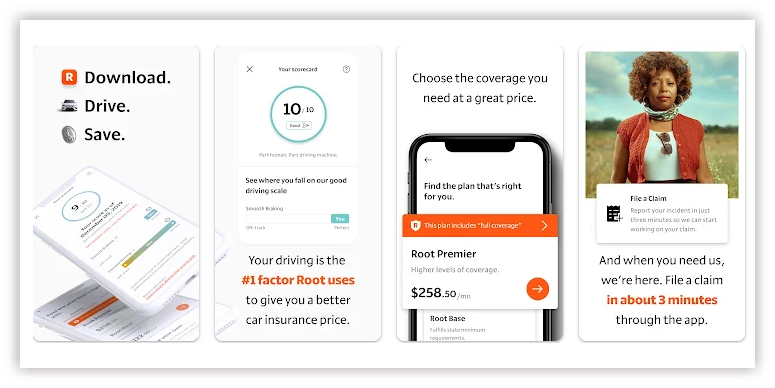

25. Root

Root Insurance Company is a subsidiary company of Root Inc, which is headquarted in Columbus, Ohio in 2015. Root provide car insurance with powerful tech to make car insurance easy, fast, and affordable.

Root: Better Car Insurance app delivers information about data safety:

- No data shared with third parties

- Data collected: location, personal info, financial info, photo and videos, files and docs, app activity, app info and performance, device or other IDs.

- Data is encrypted in transit

- Tata cannot be deleted

Build Your Own App with Rikkeisoft Mobile App Development Services

For 10 years, Rikkeisoft help banks, fintech, insurance companies & other financial institution catch up with the everchanging technological & regulatory landscape with innovative solutions & deep BFSI expertise. We catch up latest technology to innovate and secure your business, cut cost to drive more customers, increase profit margins & maintain a competitive edge from your competitors.

With our services, we save up to 35% development cost, decrease 26% in time to market for business, especially, help financial businesses deal with recession & economic instability by providing affordable IT solutions.

More From Blog

August 8, 2024

Data-Driven Product Development: Strategy To Drive More Sales

As a business owner, you want your products or services to be well-received upon launch. The most effective way to create a product that satisfies a broad range of customers is to gain insights into their needs and behaviors from the outset. The key lies in data-driven product development, a strategy that many companies have […]

August 8, 2024

7 Steps To Establish A Data-Driven Governance Program

While data-driven approaches significantly benefit organizations in various ways, failure to govern the huge data sets will hurt your business even more. Effective data management also ensures data quality and security. That’s why there is an increasingly high demand for data-driven governance programs. Continue reading for a detailed guide! What Is Data-Driven Governance? Surprisingly, many […]

August 8, 2024

Data-Driven Business Transformation: 7 Steps To Follow

Data empowers businesses to make well-informed decisions in different departments, like marketing, human resources, finance, and more. As a business owner, you should also employ data-driven approaches to skyrocket productivity and efficiency. If you are still new to this concept, scroll down for an in-depth guide on data-driven business transformation. What Does A Data-Driven Business […]

August 8, 2024

Data-Driven Security: Transforming Protection Through Analytics

Cybersecurity was once an afterthought for most organizations. But in today’s digital landscape, it has become mission-critical. With this transformation has also come a shift in how security decisions are made. Rather than relying solely on intuition and tradition, leading organizations are embracing data-driven strategies. By using metrics and insights around threats, vulnerabilities, and more, […]

August 8, 2024

Differences Between Data Science and Computer Science

Data Science and Computer Science are distinct fields overlapping in certain areas but have different focuses and objectives. The article below will help you clearly understand the differences and the close connection between the two fields. What is Data Science? Data Science is an interdisciplinary field that combines scientific methods, processes, algorithms, and systems to […]

August 8, 2024

How Real-Time Data Analysis Empowers Your Business

In today’s fast-paced business landscape, the ability to quickly make data-driven decisions has become a key differentiator for success. Real-time data analysis, the process of analyzing data as soon as it’s generated, has emerged as a powerful tool to empower business across industries. By leveraging real-time data analysis, organizations can gain timely and actionable insights, […]